Bitcoins 160% Rebound in 2023 Is a Gamble on ETF Demand Shock Yahoo Finance | Makemetechie.com Summary

News Summary

- The daily value of trades falling within 1% of the mid-price of Bitcoin on centralized exchanges has dropped 55% to about $680 million from as much as $1.5 billion in April last year, Kaiko data shows.There have been big shifts in the market share of crypto exchanges this year..

- The dominant cryptocurrency is still trading well below its November 2021 record of almost $69,000.Bitcoin miners Marathon Digital Holdings Inc. and Riot Platforms Inc., top US crypto exchange Coinbase Global Inc. and software-company-turned-Bitcoin-investor MicroStrategy all jumped as crypto markets recovered..

- Bitcoin options open interest on Deribit — the largest crypto options exchange — exceeded $16 billion for the first time in December, according to CCData..

- The wipeout contributed to a drop in liquidity, making the token harder to trade.Market depth, or the crypto market’s ability to shoulder relatively large orders without unduly impacting prices, illustrates the problem..

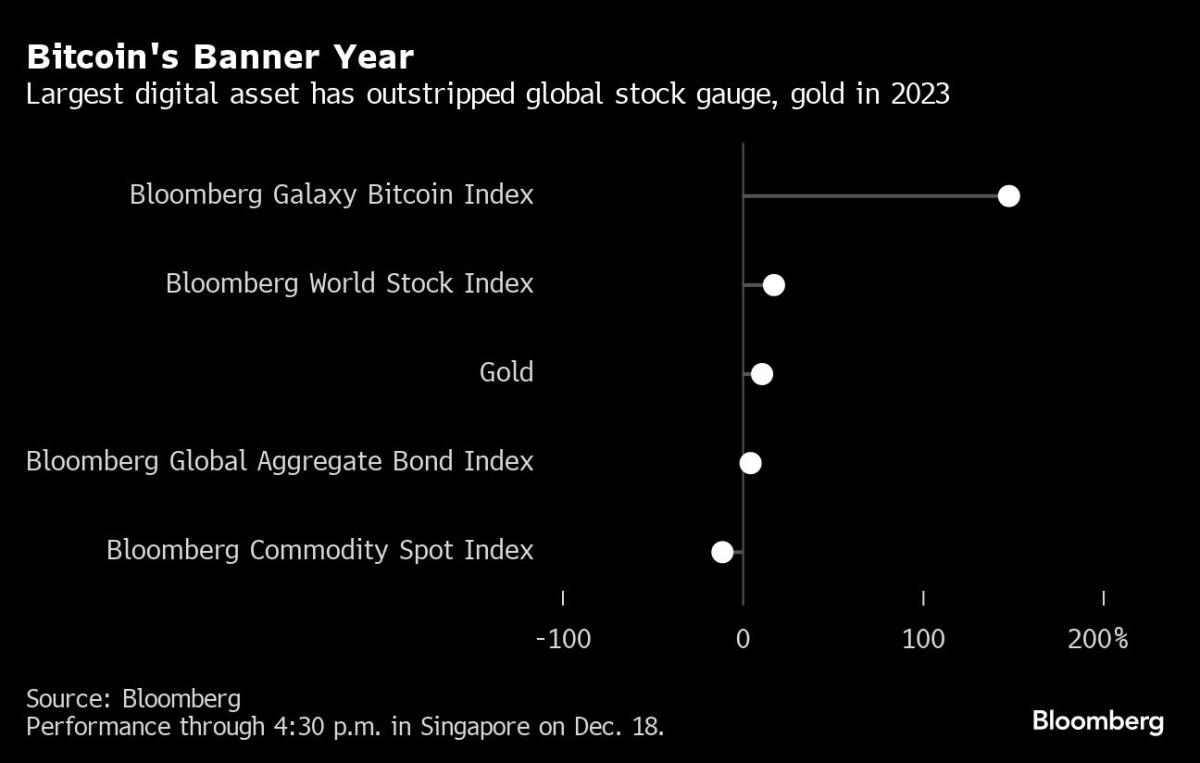

- Bankman-Fried has been jailed for fraud at FTX, and liquidity has yet to fully recover from the collapse of his empire.Here are a selection of charts showing how crypto fared in 2023.Bitcoin’s rally this year topped stocks and gold..

- Bitcoin futures open interest also hit landmark levels at CME Group, which is now vying with Binance to be the top marketplace for such instruments.The decentralized finance sector has yet to recover from the more than $40 billion collapse of the TerraUSD stablecoin project in 2022..

(Bloomberg) The sense of doom that gripped crypto markets at the end of 2022 following a $1.5 trillion wipeout has 12 months later given way to a very different sentiment avarice.Most Read from [+4531 chars]

:max_bytes(150000):strip_icc():focal(999x0:1001x2)/paris-hilton-holiday-photos-122223-tout-c3edf5a6f1f04632b79909dac99e54b5.jpg)

Never miss a story from us, subscribe to our newsletter

Never miss a story from us, subscribe to our newsletter