BlackRock Revises Spot Bitcoin ETF Proposal Ahead of Rumored SEC Approvals CoinDesk | Makemetechie.com Summary

News Summary

- Cash redemptions, which the SEC regards as the safer and more accessible redemption option, replace those shares with their equivalent cash value.BlackRock is the latest of several firms to agree to issue cash redemptions until in-kind redemptions are approved..

- ETFs typically feature one of two types of redemption and creation mechanisms: In-kind or cash.An in-kind redemption structure, which many firms say is more appealing to investors, enables firms to redeem shares for bitcoin held by their ETFs..

- Bullish group is majority owned by Block.one; both groups have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin..

- CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity.Elizabeth Napolitano is a news reporter at CoinDesk..

- In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange..

- More than a dozen firms have filed ETF applications so far..

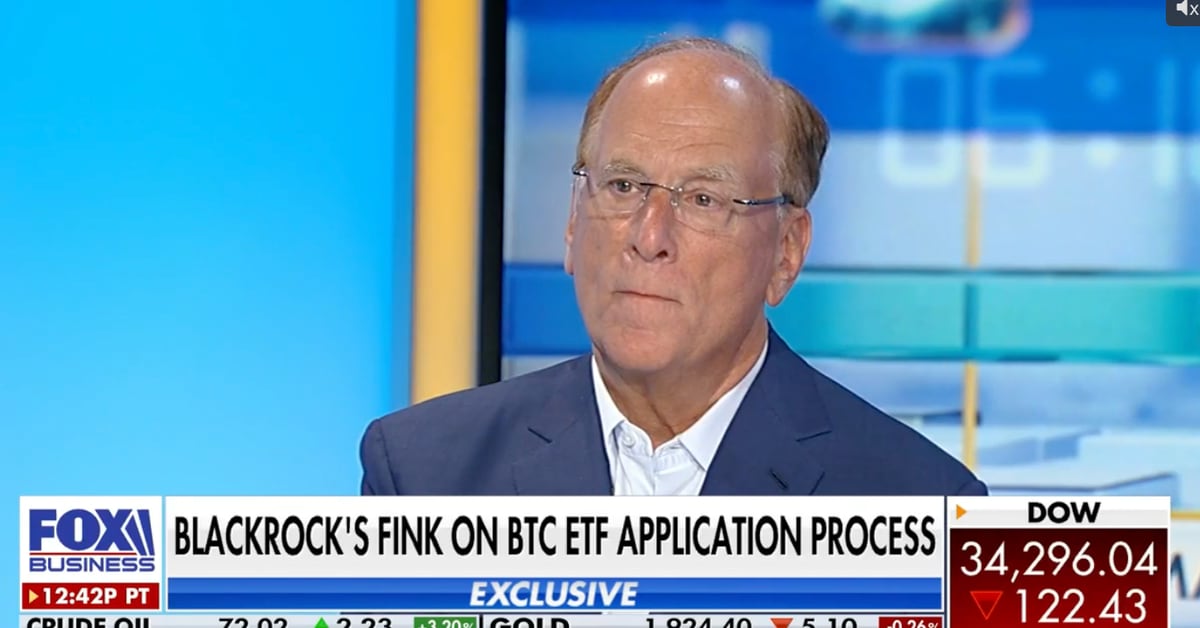

On Monday, Blackrock (BLK) filed a revised spot bitcoin (BTC) exchangetraded fund (ETF) proposal in a bid to appease regulators, likely boosting its odds of securing a firstofitskind approval in [+1426 chars]

Never miss a story from us, subscribe to our newsletter

Never miss a story from us, subscribe to our newsletter